Now is a great time to get end-of-tax-year ready, and to start thinking about how you’ll manage your income and expenditure in 2024/25.

Here are seven common end-of-tax-year mistakes you’ll want to avoid as the April deadline nears.

1. Failing to top up your pension

In April 2023, the pension Annual Allowance rose from £40,000 to £60,000. This is the amount you can pay into your pension during a tax year while still receiving tax relief.

A government top-up to encourage pension saving, relief is automatically applied at 20%. That means that a £100 increase in your pension pot only costs you £80, with £20 coming from the government.

Use the remaining months of this tax year to top-up your pension if you can afford to and maximise the relief you receive.

It’s also worth noting that as a higher- or additional-rate taxpayer, you can claim additional relief using your self-assessment tax return so act fast!

2. Misunderstanding the allowances that apply to you

Your pension Annual Allowance can change under certain circumstances so be sure you understand the one that applies to you.

If you have already started to draw pension benefits using certain “flexible” retirement options you might have triggered the Money Purchase Annual Allowance (MPAA). This cuts your allowance significantly, though, it too increased in April 2023.

The MPAA allows you to contribute £10,000 in a tax year while still receiving relief so be sure to check if you have triggered this lower allowance.

As a higher earner, you might find your allowance has been reduced thanks to the pension taper. The taper uses certain criteria to determine your “threshold” and “adjusted” income.

If you have a threshold income of more than £200,000 you will likely see your Annual Allowance be reduced by £1 for every £2 of “adjusted income” that exceeds £260,000.

The taper continues to eat into your allowance until it reaches a minimum amount of £10,000.

3. Not making the most of your ISA Allowance

As with pensions, your ISA is incredibly tax-efficient, but to maximise this tax efficiency you’ll need to make full use of your ISA Allowance.

While some allowances can be carried forward, allowing you to add unused amounts to the following tax year, this isn’t the case with your ISA Allowance. If you don’t use your full allowance by the end of 5 April 2024, you’ll lose the unused amount.

For the 2023/24 tax year, the allowance stands at £20,000. Take a look back at your ISA contributions for the year and top up if you can afford to.

4. Overlooking your child’s Junior ISA Allowance

At the same time as you check your ISA contribution history, be sure to do the same for your child’s savings.

The Junior ISA (JISA) Allowance stands at £9,000 and whether you’ve opted for a Cash or Stocks and Shares JISA the tax efficiencies it offers aligns with those for a full adult ISA. That means there’s no tax to pay on the interest you earn in a Cash JISA and Stocks and Shares JISA investment gains are free of Income Tax and Capital Gains Tax (CGT).

5. Failing to consider April 2024 changes

While many allowances have been frozen since Rishi Sunak’s Spring Budget of 2021, others are falling.

When you’re preparing for the end of the tax year you’ll need to look ahead too.

In 2023/24, the CGT annual exempt amount was slashed from £12,300 to just £6,000. This is the size of the gain you can make from a disposal without becoming liable for CGT.

If you are looking to make disposals before the end of the year, bear in mind that the annual exempt amount is due to fall again for the 2024/25 tax year. From 6 April 2024, it will stand at just £3,000 so be sure to factor that into your plans.

6. Not maximising your annual gift exemption

Back in August, you might have read 5 top tips for reducing Inheritance Tax and leaving more to your loved ones in which we spoke about your HMRC gifting allowances.

These are tax-efficient ways for you to give gifts to your loved ones during your lifetime. “Giving while living” has several advantages.

It lowers the value of your estate for Inheritance Tax (IHT) purposes while allowing you to see the difference your money makes. Opt to give some of your wealth to charity and you could even lower the rate of IHT payable on any liable portion of your estate.

Consider using your annual exemption to gift up to £3,000 for the 2023/24 tax year. You can carry forward unused allowance from the previous tax year so you could have £6,000 to gift, taking this value outside of your estate.

7. Neglecting to plan for 2024/25

While we’re all occasionally guilty of last-minute cramming after a failure to prepare, this can be costly where your finances are concerned.

If you’re leaving your end-of-tax-year preparations late this year, try to plan differently for 2024. It could be financially beneficial as well as reducing undue stress at the start of the year.

Take your ISA subscription, for example. In 2024/25, consider investing or saving your full £20,000 ISA Allowance at the start of the tax year, rather than the end. It could make a huge difference.

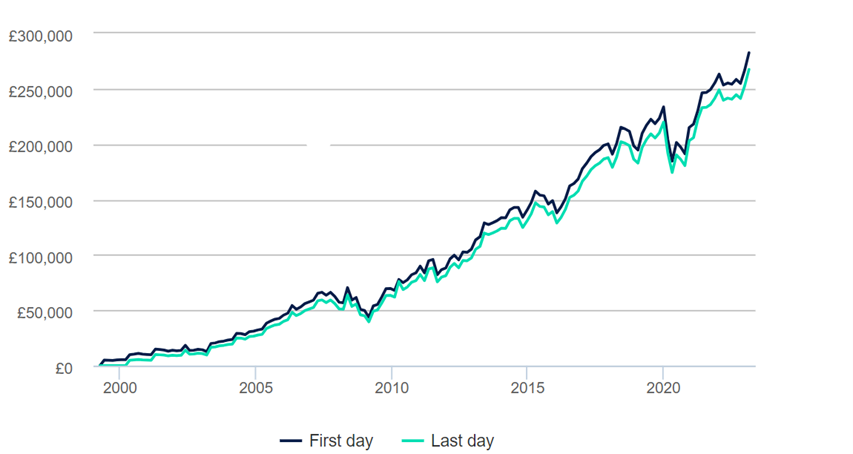

Investing on the first or last day of the tax year:

Source: Hargreaves Lansdown (Lipper IM)

Notes: Lipper IM, 06/04/99 to 30/03/23. Includes 2022/23 subscriptions for both. Last subscription of 2022/23 tax year paid on 30 March.

The above graph shows £5,000 invested in a Stocks and Shares ISA each year since 1999. Investing on the first, rather than the last day of the tax year, would have seen you £9,587 better off.

Investing early, whether into your pension or ISA, gives an extra year of potential tax-efficient growth and could get your 2024/25 tax year off to the best possible start.

Get in touch

If you have any questions or concerns as you approach tax year end, speak to us now. Please contact us on info@janesmithfinancial.com or call 01234 713131.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

Production

Production