The latest Office for National Statistics figures confirm that inflation dropped to 3.4% for the 12 months to February.

While the price of household goods is now rising at its slowest rate since October 2021, the current figure remains above average for the last 10 years and 1.4 percentage points higher than the Bank of England’s 2% target.

Falling inflation is good news for consumers but millions of UK households are still feeling the squeeze. This is a result of high energy bills, increased mortgage tariffs, and stealth taxes in the form of allowance and threshold freezes.

It is into this climate that the Pension and Lifetime Savings Association (PLSA) released its latest retirement living standards report.

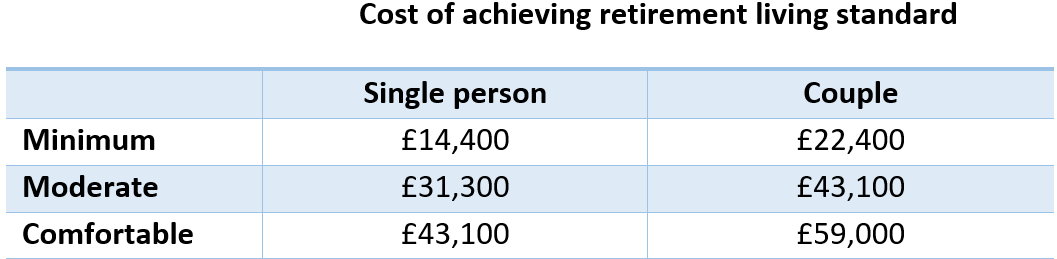

The PLSA’s updated figures reveal the costs for three different retirement living standards, for couples and single households. Unsurprisingly, costs are on the up. So too is the appetite for experiences and creating memories, over the amassing of material possessions.

Kee reading for a closer look at the report, how to make sure you retire with “enough”, and how you might opt to spend your retirement income.

The PLSA finds that the cost of retirement is rising amid increasing costs

The PLSA report breaks down retirement living standards into three categories:

- Minimum – Defined as a lifestyle in which your needs are covered, with some money left over for wants.

- Moderate – This lifestyle brings financial security and greater flexibility. You have the chance to do more of the things you want to do, like enjoying meals out as a family.

- Comfortable – A “comfortable” lifestyle provides the opportunity to be spontaneous, enjoy foreign family holidays, help others, and worry less about day-to-day spending.

Your long-term plan will be designed to provide you you’re your desired retirement lifestyle.

The report goes on to break down the cost of these lifestyles for a single person, and couples.

A BBC report looked into the size of the pension pot required to meet the PLSA’s updated figures.

It found that if you’re looking to buy an annuity or opt for drawdown at retirement, you’ll need a pot of between £490,000 and £790,000 to maintain a comfortable living standard.

How much you need to save will depend on the standard of living you are happy to lead and what you want your retirement to look like.

Retirees’ priorities have shifted post-Covid, as reflected in the family focus of each retirement lifestyle, and the cost of living crisis has only strengthened the move away from material possessions to experiences and creating memories.

Nearly three-quarters of over-55s value experiences over material possessions

You’ll have plenty of free time in retirement to do exactly what you want to do. But only if you can afford it.

Back in 2022, a Royal London survey found that 72% of over-55s valued experiences over material possessions.

This included using retirement income to fund big-ticket items like world travel. But it also included memory-making closer to home. This might mean spending time with family and friends or re-engaging with hobbies.

The retirees surveyed broke down their retirement goals as follows:

- Spending time with family and friends (52%)

- Relaxing (47%)

- Maintaining health and fitness (45%)

- Travelling (37%)

- Spending time on hobbies (37%).

The focus on experiences is clear, so making sure you have enough money to create these memories is key.

Your long-term retirement plans are designed to make sure you have “enough”

At Jane Smith, we take the time to get to know you. That means we fully understand your aspirations and can plan your savings to ensure you’ll have “enough”, whatever your dream retirement looks like.

The cost of living crisis has resulted in a rising cost of retirement living standards. It has also – alongside the pandemic – forced a re-evaluation of priorities, leading to an increased focus on experiences over material possessions.

Careful pension saving, through a robust long-term financial plan, can help you to live the life you want after work. Whether this means ticking experiences off your bucket list, spending more time with loved ones, or learning something new, we can help, so get in touch now.

Get in touch

If you have any questions about your long-term retirement plans or you want reassurance that you’ll have “enough”, speak to us now. Please contact us on info@janesmithfinancial.com or call 01234 713131.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

Production

Production